Bayesian interrupted time series with R & {brms}: Part 2/2

This post is the second of two parts. The focus here is on Bayesian interrupted time series modelling using data simulated in part 1 to depict a public health surveillance and intervention program.

Recap

In this post we continue our journey using Bayesian Interrupted Time Series (ITS) analysis to understand the impact of Drug X on a novel infection. Previously, we prepared a simulated dataset depicting a disease intervention scenario. By creating the dataset, we know the generative process which makes it easier to understand how well various models will fit to the data sample. If you missed the first post and are interested in how the data for this part was simulated, you can jump there now. If not, let us proceed with Bayesian modelling! As before, we will first set our seed variable and load some necessary libraries.

# Assign seed for R and to later BRM fits

seed_value <- 145

set.seed(seed_value)

# Libraries

library(ggplot2)

library(brms)

# Load pre-computed to make sure its a stable copy

sim_data <- readRDS('sim_data.rds')Bayesian ITS

Why Bayesian?

It should come as no surprise by this point that we will create the ITS models from a Bayesian perspective. There are several reasons for this choice, most of which I will not elaborate for sake of brevity (and perhaps the reader’s sanity). However I will say this, many people appreciate the Bayesian approach as it is more aligned to how we actually think about probability; it also encourages us to understand our choice of statistical model. What does that mean exactly? Well, Bayesian models are generative models. Based on our prior belief, it can produce output even before it sees any data. This may sound weird but it is very powerful and useful when done correctly. For example, we can leverage knowledge from other studies, such as randomized controlled trials (RCTs), to inform the starting point for our models. RCTs are typically a strong source of evidence, so why throw away important information!? If the prior knowledge is wrong, enough data should shift this belief in a new direction. If this is your first time with Bayesian statistics, or just need a refresher, you may want to read a primer on the topic available in the references.

Our first ITS model

The first step is to decide on a statistical model. As our outcome of interest is the number of cases, an obvious choice will be the Poisson distribution but others could be equally suitable (e.g. Negative Binomial). The main parameter to estimate is lambda (

Prior thought

Before we start looking at models any further let us first understand the prior terms for

An uninformative prior makes no assumption on the distribution for the parameter being modeled. This is sometimes called a flat prior or uniform prior and is essentially the same assumption of Frequentist approaches. However, it is uncommon to have no prior notion of what our parameters are. We typically have at least a general sense of what they could be. This is often very useful information. As mentioned earlier, if we have details from clinical trials, or similar trustworthy information, why throw that away? By providing a weakly informative prior the Bayesian models often perform better during the fitting procedure (e.g. MCMC) since they won’t spend as much time exploring the parameter space far from a sensible starting point unless the data has enough evidence to tell the process otherwise. When using weak priors the weight of evidence within our dataset can easily overcome any of our prior belief. There are other types of priors too, such as informative and shrinkage priors, which we won’t cover here.

Understanding the behaviour of priors

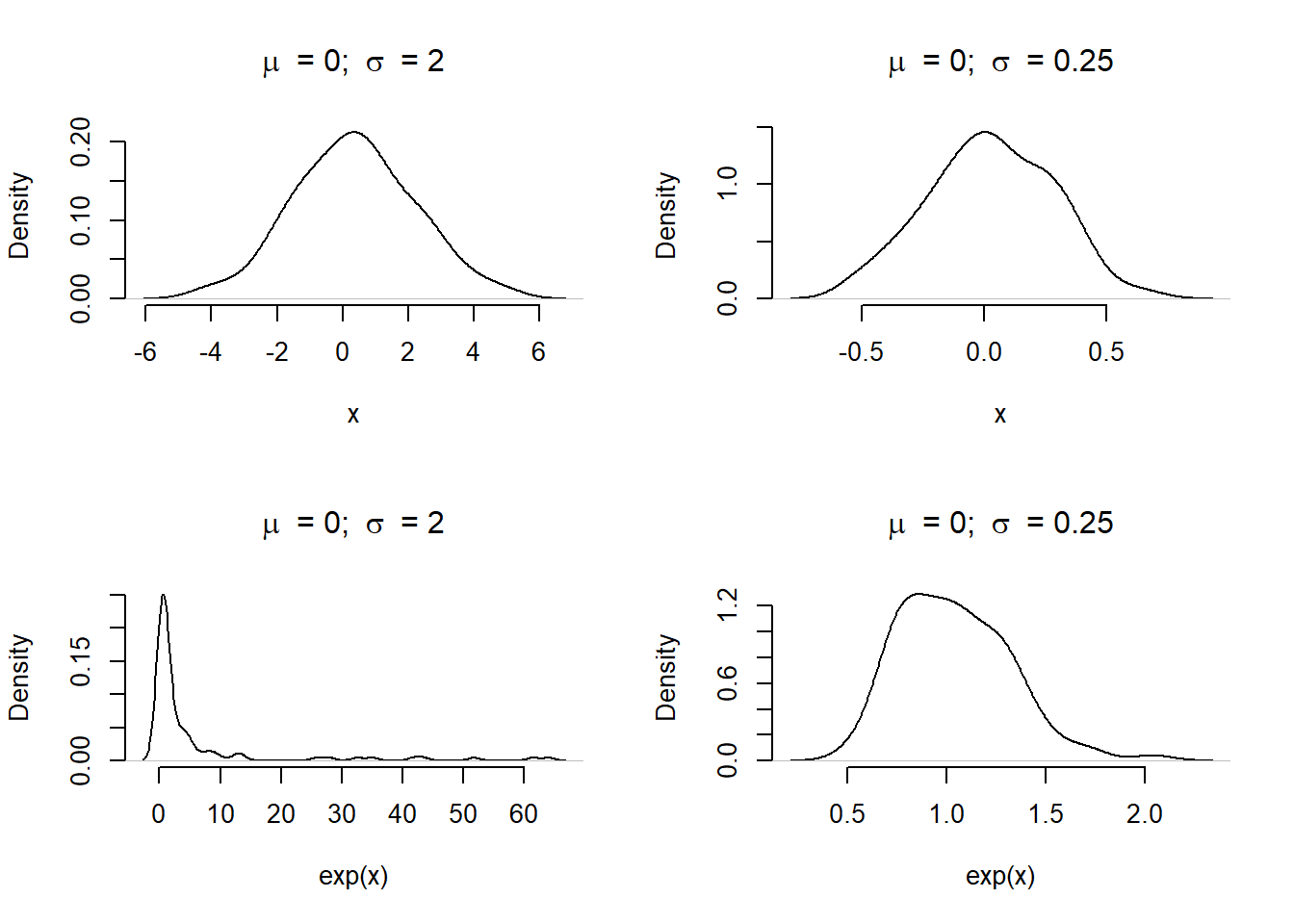

We are using a log-link function to connect our ITS model of linear terms back to the parameter

par(mfrow=c(2,2))

# Natural scale

plot(density(rnorm(100, 0, 2)),

main = expression(mu~' = 0; '~sigma~' = 2'),

xlab = 'x', frame.plot = FALSE)

plot(density(rnorm(100, 0, 0.25)),

main = expression(mu~' = 0; '~sigma~' = 0.25'),

xlab = 'x', frame.plot = FALSE)

# Exp scale

plot(density(exp(rnorm(100, 0, 2))),

main = expression(mu~' = 0; '~sigma~' = 2'),

xlab = 'exp(x)', frame.plot = FALSE)

plot(density(exp(rnorm(100, 0, 0.25))),

main = expression(mu~' = 0; '~sigma~' = 0.25'),

xlab = 'exp(x)', frame.plot = FALSE)

Figure 1: Density of values when sampling from a Normal distribution with a natural or log-link function. Without careful attention to the relationship, the distribution can produce wild results (most notably in the bottom left panel).

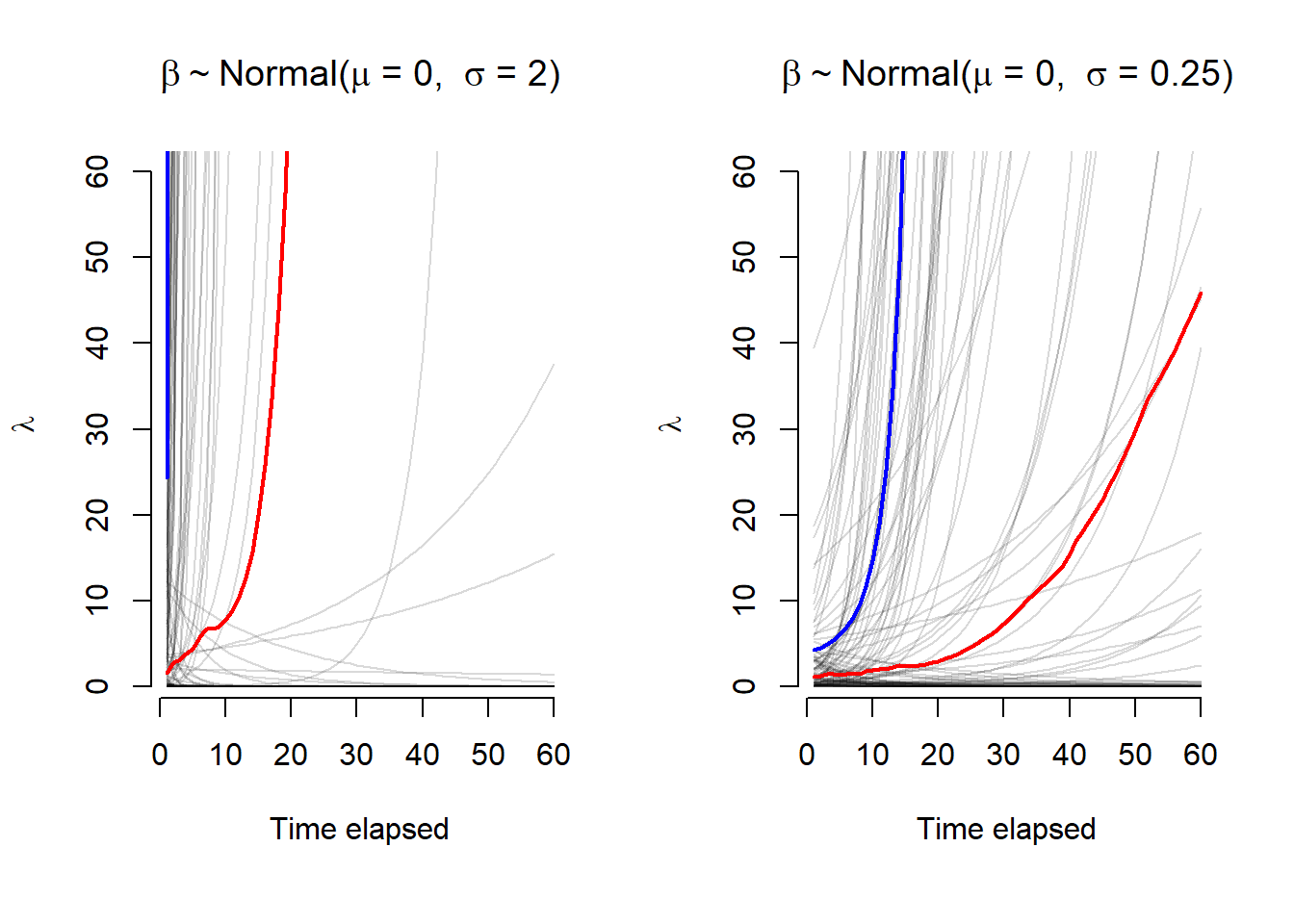

What does this mean for the model predictions? If we select priors poorly, how does this impact expected values (e.g. case counts) from the Poisson distribution? The helper function below, prior_pred_plot(), will assist in this visually. Assuming a model of

# Helper function to check basic prior selections

prior_pred_plot <- function(alpha, beta, x, ...) {

par(mar = c(6, 4, 4, 2) + 0.1, xpd=FALSE)

y_prior <- mapply(FUN = \(a,b) exp(a + b * x),

a = alpha, b = beta)

plot(x = 1:length(x),

type = 'n',

xlab = 'Time elapsed',

ylab = expression(lambda),

frame.plot = FALSE,

...)

for(i in 1:ncol(y_prior)) {

lines(x = 1:length(x), y = y_prior[,i], col=alpha(rgb(0,0,0), 0.15))

}

lines(x = 1:length(x), apply(y_prior, MARGIN = 1, FUN = median), col = 'red', lwd = 2)

lines(x = 1:length(x), apply(y_prior, MARGIN = 1, FUN = mean), col = 'blue', lwd = 2)

par(xpd=TRUE)

legend(x='bottom',cex = 0.8,

inset = c(-0.3, -0.5),

ncol = 3,

legend = c('Simulated', 'Median', 'Mean'),

col = c(alpha(rgb(0,0,0), 0.2), 'red', 'blue'),

lty = 1,

bty = 'n')

}Let us plot the prior distributions that used the log-link as before, with focus on changes to the

par(mfrow=c(1,2))

prior_pred_plot(alpha = rnorm(100, 0, 2),

beta = rnorm(100, 0, 2),

x = sim_data$months_elapsed,

main = expression(beta %~% "Normal("*mu*" = 0, " ~ sigma*" = 2)"))

prior_pred_plot(alpha = rnorm(100, 0, 2),

beta = rnorm(100, 0, 0.25),

x = sim_data$months_elapsed,

main = expression(beta %~% "Normal("*mu*" = 0, " ~ sigma*" = 0.25)"))

Figure 2: Expected values (

The

As an aside, the R package {brms} provides methods to sample the prior distribution of models by using the parameter sample_prior = 'only' from brm(). To plot visuals, this can be paired with the {bayesplot} function pp_check(). However, for the sake of time, we will skip this.

Prior selection

Before moving on, let’s decide on priors for a Bayesian ITS model using a Poisson distribution. As we will be using {brms} for our modelling purposes, we use the set_prior() or prior() functions to define our selection.

The prior value for prior(normal(mu = 0, sigma = 1)). This particular choice translates to a small expected value (i.e. cases), with most of the distribution weight being less than 20. If we choose a larger

The ITS model could have various prior(normal(mu = 0, sigma = 0.25)). This translates to only a small possible increase or decrease in the expected value for cases. In other words, we expect the

basic_prior <- c(prior(normal(0, 1), class = Intercept),

prior(normal(0, 0.25), class = b))Fitting ITS models with {brms}

No intervention

Before we even consider a model with the intervention terms, let us first see what the results are for a model that includes just time and month. We will use the brm() function to perform the model fit; this will operate similarly to glm(). Although the first three parameters may look familiar, the others may not if you have not done Bayesian regression before. This is beyond the scope of this post but further details can be explored in the references.

# Only model time effect

model_time <- brm(cases ~ months_elapsed,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1000)

# Only model time and month effect

model_time_season <- brm(cases ~ months_elapsed + months,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1000) At this point we would typically perform some model checks. We will save that for later after we have a few more models to compare and do it all at the same time. For now, let us compare how each of these models predict against the original data.

plotA <- as.data.frame(predict(model_time, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('A: Time only')

plotB <- as.data.frame(predict(model_time_season, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('B: Time + Month')

gridExtra::grid.arrange(plotA, plotB, nrow = 2)

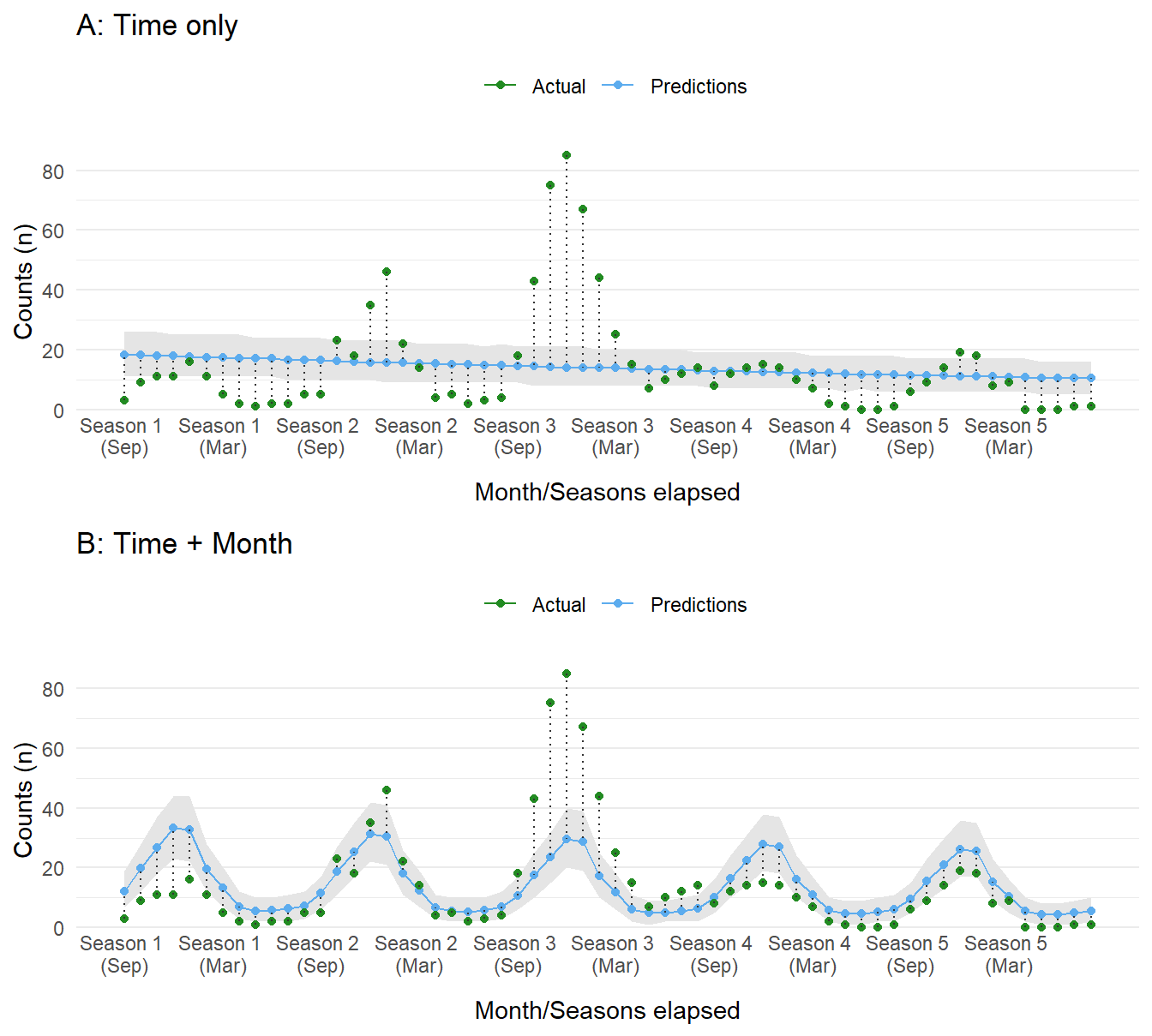

Figure 3: Compare dataset to predictions sampled from the posterior distribution of each model. Panel A shows values for the time-only model, whereas panel B shows results from the time and month model.

Without considering any other factors, the first model with just time as a predictor does not perform well, expecting a slow decrease in cases. The second model with month included fares a bit better, capturing some of the seasonal components. The performance of both models is, as expected, poor. This is in part due to the lack of information about the intervention and its influence on case counts.

Compare impact models

As shown in the previous section, in order to model this data effectively we need to consider the intervention period. The choice now is which impact model to choose. To understand the differences, we will model three options (ignoring seasonal effects for the time being):

- Level change only:

cases ~ months_elapsed + event - Slope change only:

cases ~ months_elapsed + event_elapsed - Level and slope change:

cases ~ months_elapsed + event + event_elapsed

# Only level change at event (i.e. intervention)

model_level <- brm(cases ~ months_elapsed + event,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1000)

# Only slope change at event (i.e. intervention)

model_slope <- brm(cases ~ months_elapsed + event_elapsed,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1000)

# Include both a level change and slope change at time of event (i.e. intervention)

model_level_slope <- brm(cases ~ months_elapsed + event + event_elapsed,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

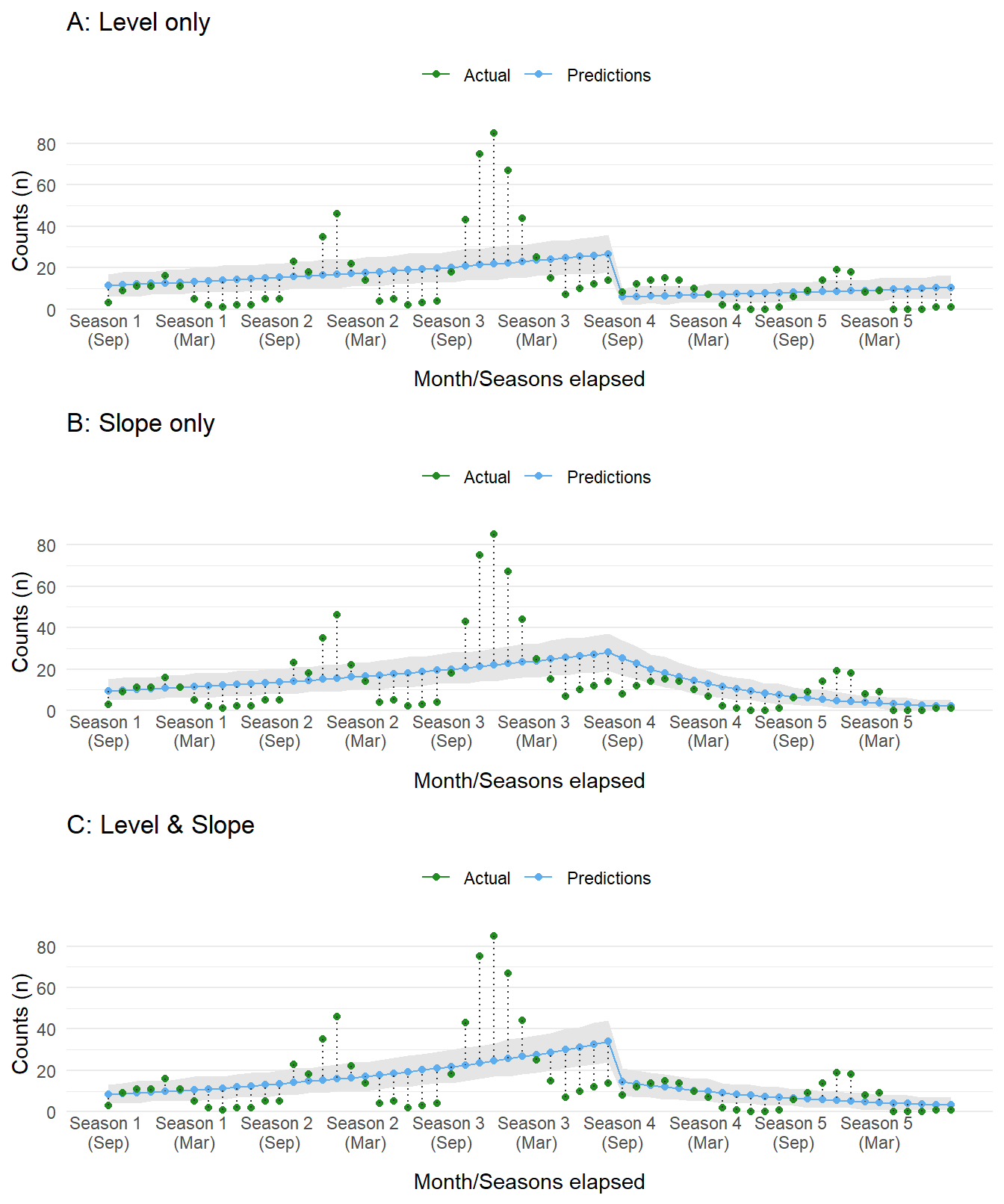

warmup = 1000) As before, let’s plot the predictions from the model. All three capture an assumption regarding the effect of the intervention. The first assumes a drop followed by a slow increase. The latter two assume a slow decrease or rapid dip followed by a slow decrease in cases over time. The choice should, ideally, be informed by causal reasoning. In our scenario, we expect the campaign for Drug X to have a large impact during the initial roll out followed by a gradual decrease as the program expands to other populations and effects percolate throughout the population.

plotA <- as.data.frame(predict(model_level, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('A: Level only')

plotB <- as.data.frame(predict(model_slope, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('B: Slope only')

plotC <- as.data.frame(predict(model_level_slope, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('C: Level & Slope')

gridExtra::grid.arrange(plotA, plotB, plotC, nrow = 3)

Figure 4: Compare dataset to predictions sampled from the posterior distribution of each ITS model. Each panel displays a different type of ITS impact model.

Include seasonality

Since we created the dataset, and because it is obvious from our initial plots, we know there is a seasonal influence in the data. Furthermore, since we are working with time-series data there is the ever present concern of correlation between data points (i.e. autocorrelation). In other words, data are related to each other with respect to time, possibly with data points closer in time being more similar compared to those far apart. Dealing with this phenomenon is an entire field of study. To just scratch the surface, we could resolve this model bias by simply adding a seasonal term. This may not be enough and other strategies incorporate autoregressive terms (ar()) into the model. Typically, these are lagged response variables used as predictors (i.e. the outcome at a previous time to predict the current data point). From my understanding, {brms} implements autoregressive terms on the residuals instead of on response variables. If that is not desired, one could create lagged terms and add those to the model manually. One criticism of autoressive terms is the lack of causal reasoning for lags beyond one period (see Richard McElreaths’ book: Statistical Rethinking). Additionally, these models appear to be a bit difficult to fit using Stan!

We will attempt to model seasonality in three different models.

- Categorical variable

months - Spline interpolation of

months - Autoregressive term on residuals with lag of 1 (

ar(p = 1))

# Model season by month in year

model_level_slope_season <- brm(cases ~ months_elapsed + event + event_elapsed + months,

data = sim_data,

family = poisson(),

seed = seed_value,

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1000)

# Model season with splines instead of categories

model_level_slope_season_s <- brm(cases ~ months_elapsed + event + event_elapsed + s(months_int),

data = sim_data,

family = poisson(),

seed = seed_value,

control = list(adapt_delta = 0.97),

prior = basic_prior,

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

warmup = 1500)

# Model with auto-regressive component for autocorrelation impacts

model_level_slope_season_ar <- brm(cases ~ months_elapsed + event + event_elapsed + months + ar(p = 1, cov = TRUE),

data = sim_data,

family = poisson(),

seed = seed_value,

control = list(adapt_delta = 0.99, max_treedepth = 12),

prior = c(prior(normal(0, 2), class = Intercept),

prior(normal(0, 1), class = b),

prior(normal(0, 1), class = ar, ub = 1, lb = -1)),

chains = 4, cores = 4,

sample_prior = 'yes',

save_pars = save_pars(all = TRUE),

iter = 2500, warmup = 1500) As before, we plot the model expectations against the actual data. These look much better than before. All three appear to have a similar performance, with the first model with a categorical term for month underestimating the counts at the largest peak in the third season.

plotA <- as.data.frame(predict(model_level_slope_season, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('A: Categorical')

plotB <- as.data.frame(predict(model_level_slope_season_s, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('B: Spline')

plotC <- as.data.frame(predict(model_level_slope_season_ar, probs = c(0.05, 0.95))) |>

cbind(sim_data) |>

ggplot_its_base(n_years = n_years) +

ggplot_its_pred() +

ggtitle('C: Autoregressive')

gridExtra::grid.arrange(plotA, plotB, plotC, nrow = 3)

Figure 5: Compare dataset to predictions sampled from the posterior distribution of an ITS model (slope + level) with different approaches for incorporting seasonality and autocorrelation.

Model checking

We have run several models but have so far skipped some important checks. This is important before going any further. The analyses below are just a subset of what can be examined.

Autocorrlation Function (ACF) Plots

We have noted several times that autocorrelation is of great concern when modeling time-series data. An ACF plot compares the correlation of model residuals for a provided number of lags. A lag of 0 should have complete autocorrelation and ideally this rapidly decreases in subsequent lags. Looking at a subset of models depicted earlier, several interesting features can be seen. First, when no term related to season (i.e. month) is included, there are periods of positive and negative correlation in the residuals. After seasonality is included, the periodic pattern pattern diminishes and quickly falls between the confidence interval (blue dashed lines). The categorical term of month at lag 1 still has evidence of autocorrelation in the residuals. However, once we use a spline term, this autocorrelation is further diminished.

model_list <- list('slope' = model_slope,

'level' = model_level,

'level_slope' = model_level_slope,

'level_slope_season' = model_level_slope_season,

'level_slope_season_s' = model_level_slope_season_s,

'level_slope_season_ar' = model_level_slope_season_ar)

par(mfrow=c(3,2))

for(i in names(model_list)) {

acf(residuals(model_list[[i]])[,'Estimate'], main = i)

}

rm(model_list)

Figure 6: Autocorrelation function plots for several ITS models.

Sampling checks

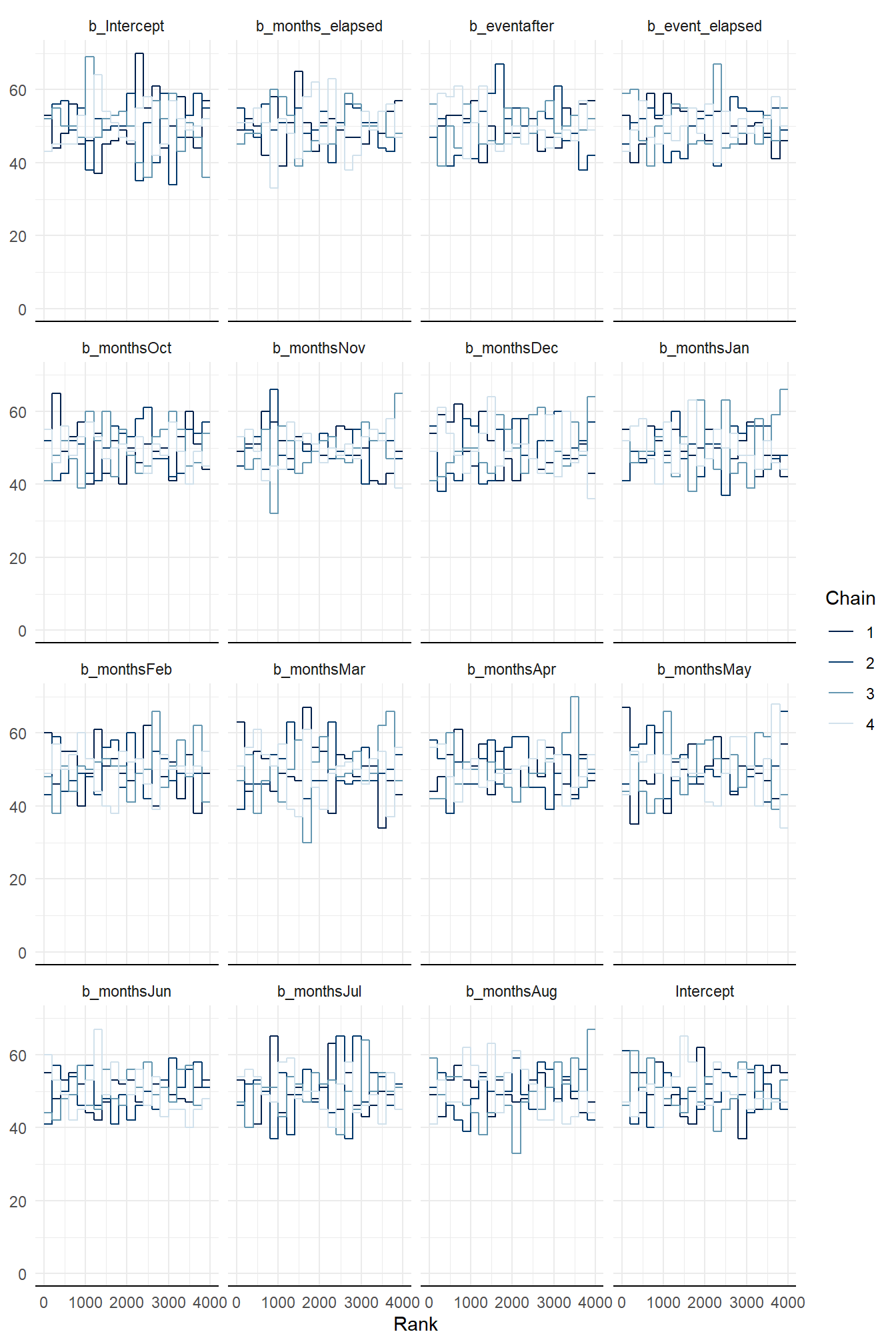

When using {brms} the default fitting procedure is sampling via Hamiltonian Monte Carlo (HMC) to estimate the parameters values. Typically, several parallel sampling processes are run. In our case we ran four chains and we need to check they are “healthy”. In brief, a healthy chain will have no obvious pattern; it should be stationary without large blips, dips, or trends. The chains should also overlap as much as possible. Any indication otherwise means the chains did not mix well and the sampling process was struggling. This can be inspected by a trace or trace rank (a.k.a trank) plot. To keep things simple, let’s look at the trank plot outputs for model_level_slope_season. All the chains appear to overlap and are relatively stationary.

bayesplot::mcmc_rank_overlay(model_level_slope_season,

pars = vars(!contains('prior') & !matches('lp__'))) +

theme_minimal()

Figure 7: Trank plots of Markov chains for parameters of model_level_slope_season.

Model summary

There are a couple diagnostic metrics available that can provide a general sense of model health. One of these is called Rhat (

model_level_slope_season## Family: poisson

## Links: mu = log

## Formula: cases ~ months_elapsed + event + event_elapsed + months

## Data: sim_data (Number of observations: 60)

## Draws: 4 chains, each with iter = 2000; warmup = 1000; thin = 1;

## total post-warmup draws = 4000

##

## Population-Level Effects:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## Intercept 1.46 0.12 1.21 1.70 1.00 3855 3054

## months_elapsed 0.06 0.00 0.05 0.07 1.00 6242 2964

## eventafter -1.34 0.13 -1.59 -1.10 1.00 5404 3278

## event_elapsed -0.10 0.01 -0.13 -0.08 1.00 4998 2684

## monthsOct 0.60 0.12 0.37 0.83 1.00 4304 3011

## monthsNov 0.88 0.11 0.67 1.10 1.00 3747 2876

## monthsDec 1.08 0.10 0.88 1.28 1.00 3494 3015

## monthsJan 1.02 0.11 0.81 1.23 1.00 3771 3392

## monthsFeb 0.48 0.12 0.25 0.71 1.00 4055 3241

## monthsMar 0.05 0.13 -0.21 0.30 1.00 4622 3003

## monthsApr -0.60 0.16 -0.90 -0.29 1.00 5190 3000

## monthsMay -0.82 0.16 -1.14 -0.51 1.00 5286 3012

## monthsJun -0.85 0.16 -1.17 -0.54 1.00 5150 2702

## monthsJul -0.79 0.16 -1.10 -0.48 1.00 5709 3333

## monthsAug -0.67 0.15 -0.96 -0.39 1.00 5330 3195

##

## Draws were sampled using sampling(NUTS). For each parameter, Bulk_ESS

## and Tail_ESS are effective sample size measures, and Rhat is the potential

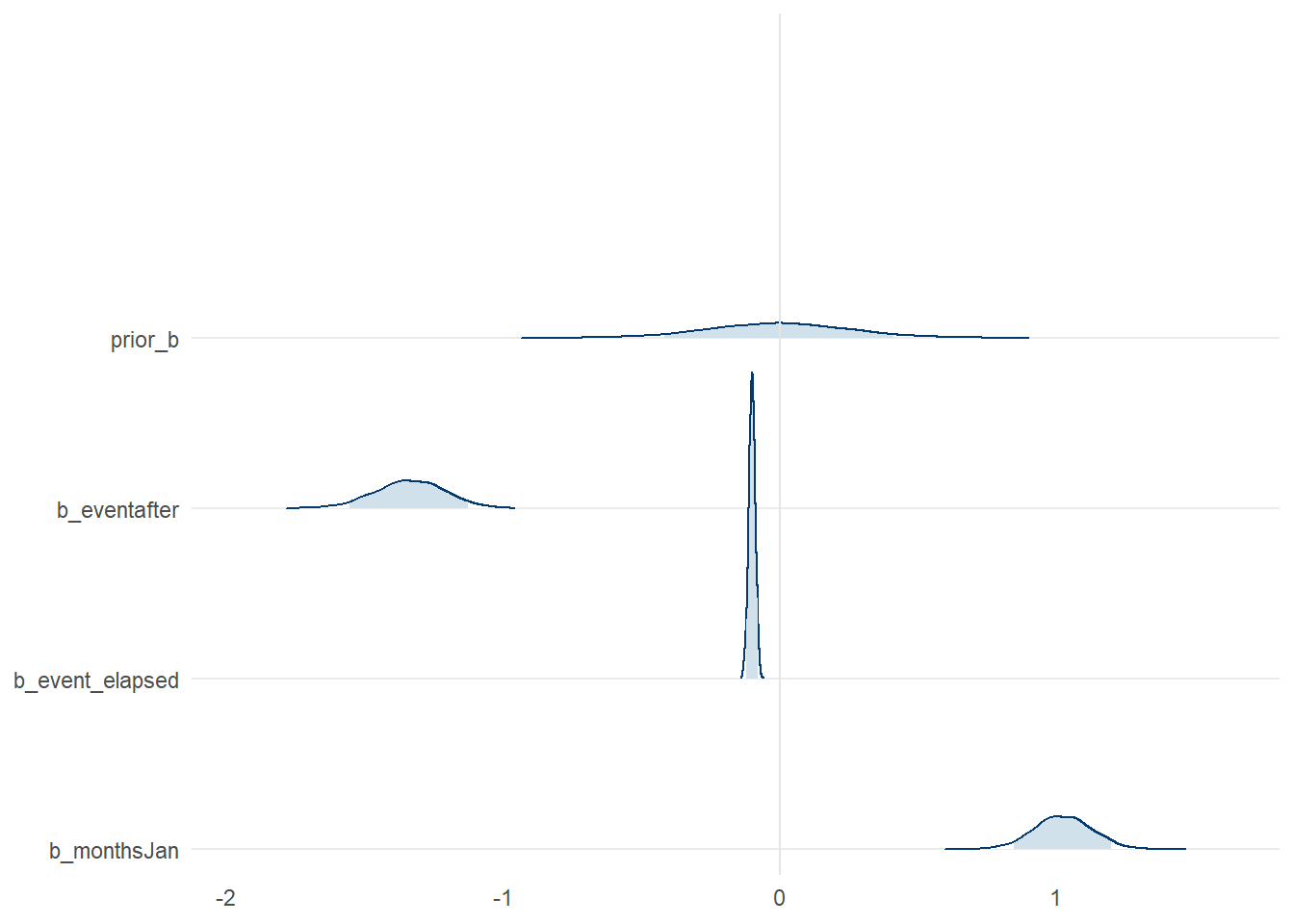

## scale reduction factor on split chains (at convergence, Rhat = 1).Looking at table of values is not easy to understand the patterns for the parameter (i.e. model_level_slope_season such as: (a) the intervention level change (b_eventafter), the time since the intervention (slope change, b_event_elapsed), and the monthly effect for January (b_monthsJan).

bayesplot::mcmc_areas_ridges(model_level_slope_season,

pars = c('prior_b', 'b_eventafter', 'b_event_elapsed', 'b_monthsJan'),

prob = 0.91) +

theme_minimal() +

theme(panel.grid.minor.x = element_blank(),

panel.grid.major.x = element_blank())

Figure 8: Posterior distribution of select parameter values from model_level_slope_season, compared to the prior distribution

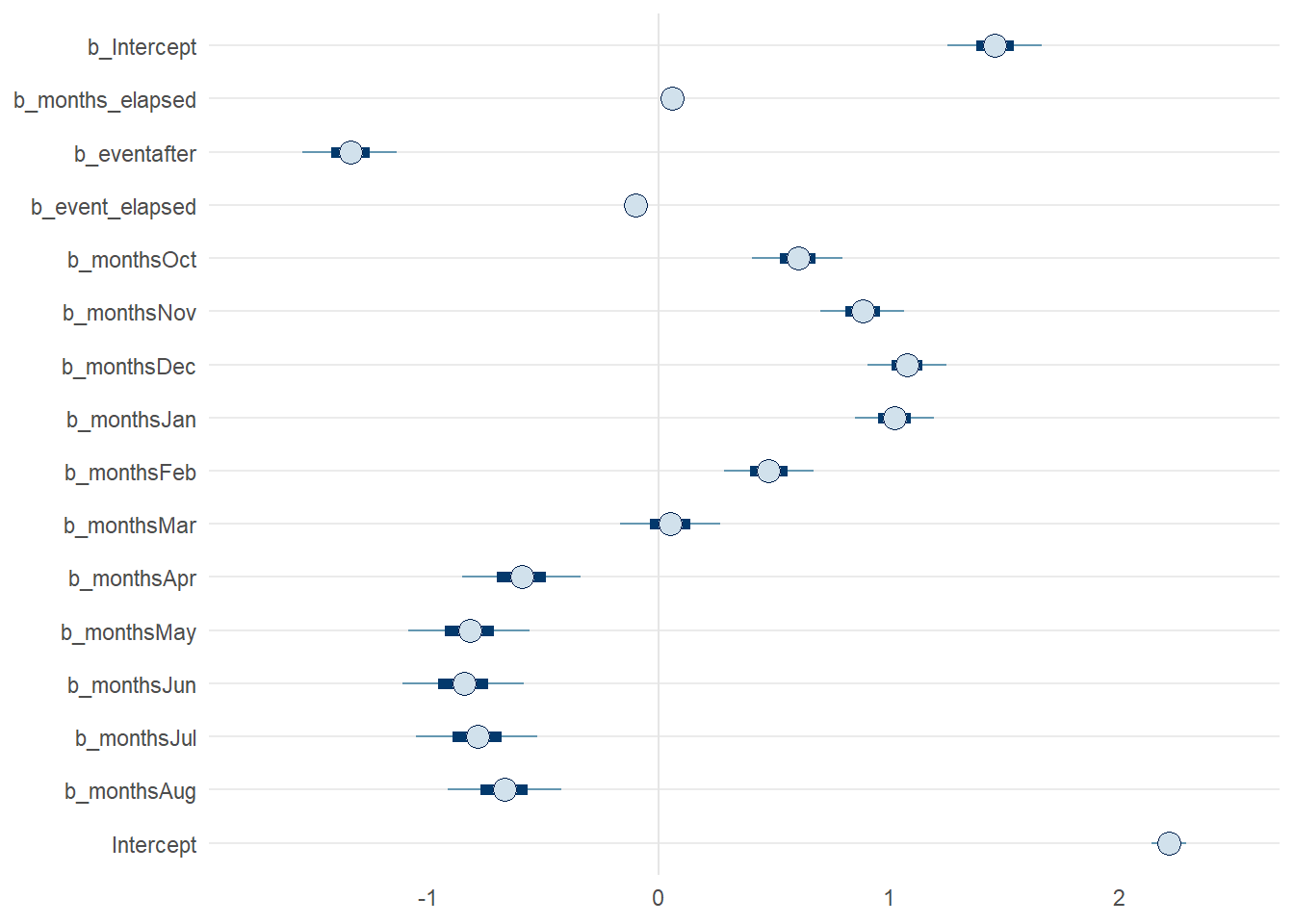

Overall, we can see the parameters have some strong patterns which deviate quite drastically from our prior in some respects. If you want to see all the model parameters plotted at once, along with their credible intervals, we can use mcmc_intervals() to examine them compactly.

bayesplot::mcmc_intervals(model_level_slope_season,

pars = vars(!contains('prior') & !matches('lp__'))) +

theme_minimal() +

theme(panel.grid.minor.x = element_blank(),

panel.grid.major.x = element_blank())

Figure 9: Posterior parameters from model_level_slope_season with 50% and 90% credible intervals

Posterior predictive checks

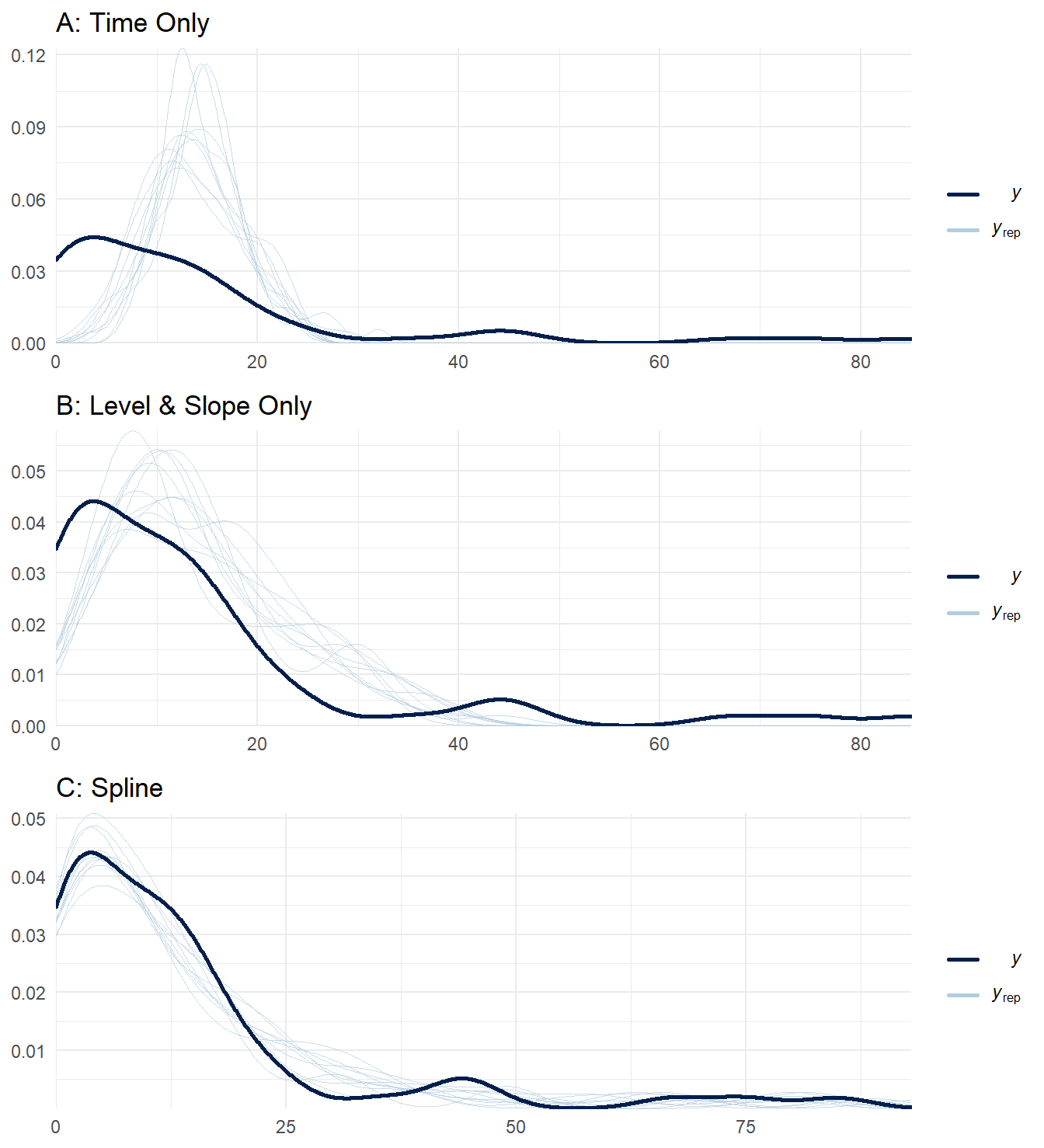

Just as we needed to do various checks on our prior values, we should do the same for the posterior. These are samples from the fitting process which considers both the prior values and data together. The pp_check() convenience function makes this quite easy by plotting the observed response against samples taken from the fitted model. Our aim is for a model that, at least in general, has samples that overlap with the observed data. Using three of our models, we can compare the output from pp_check(). Unsurprisingly, the model that includes both the intervention and seasonal effects (Panel C) fits better than the rest.

plotA <- pp_check(model_time) + theme_minimal() + ggtitle('A: Time Only')

plotB <- pp_check(model_level_slope) + theme_minimal() + ggtitle('B: Level & Slope Only')

plotC <- pp_check(model_level_slope_season_s) + theme_minimal() + ggtitle('C: Spline')

gridExtra::grid.arrange(plotA, plotB, plotC, nrow= 3)

Figure 10: Posterior predictive checks for three ITS impact models.

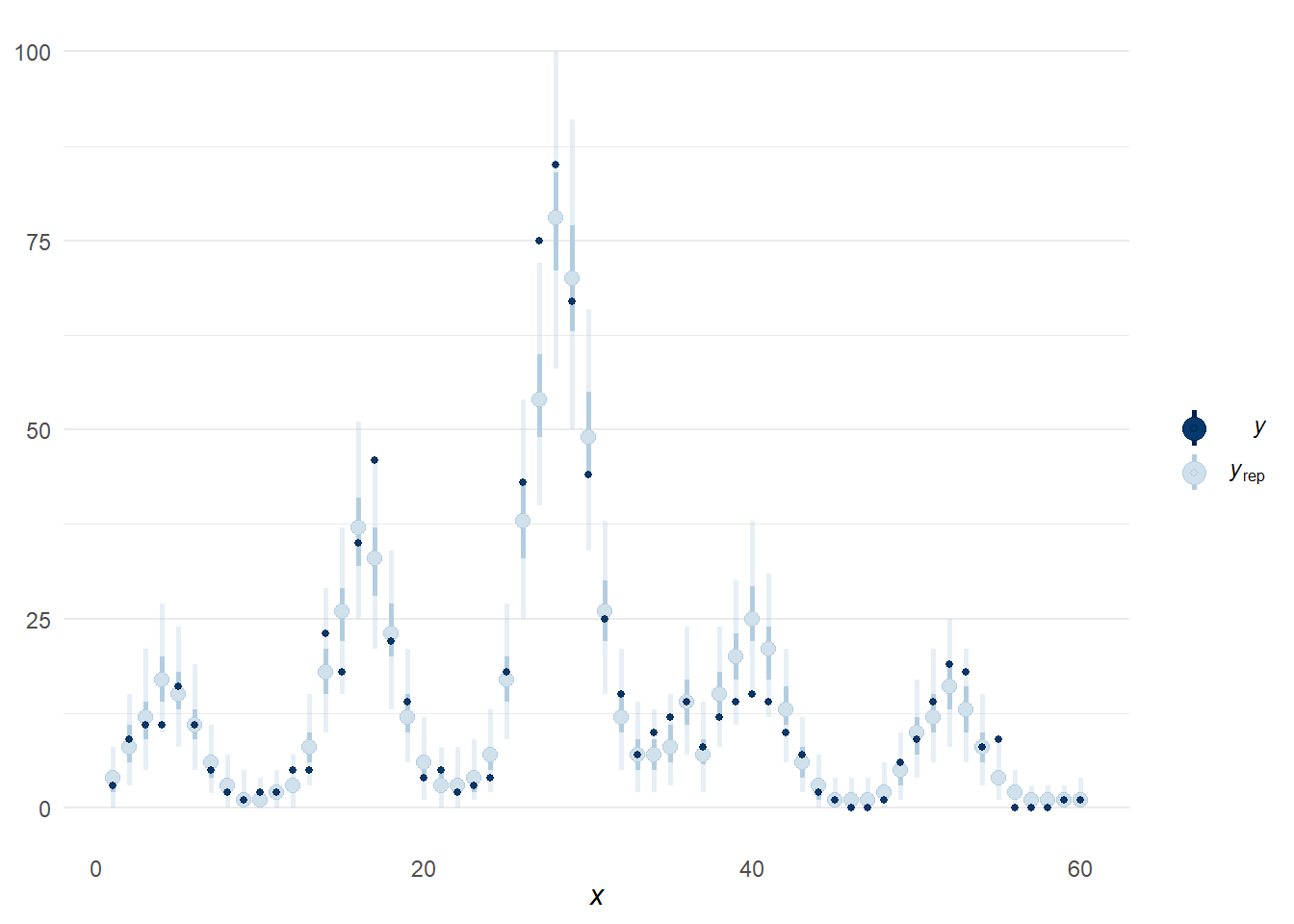

There several alternatives to pp_check(), sometimes it is easier to examine the predictions along the time scale using ppc_intervals(). This output is very similar to the plots made in previous sections.

bayesplot::ppc_intervals(y = sim_data$cases,

x = sim_data$months_elapsed,

posterior_predict(model_level_slope_season_s),

prob = 0.5, prob_outer = 0.95) +

theme_minimal() +

theme(panel.grid.minor.x = element_blank(),

panel.grid.major.x = element_blank())

Figure 11: Alternative posterior predictive check using function ppc_intervals().

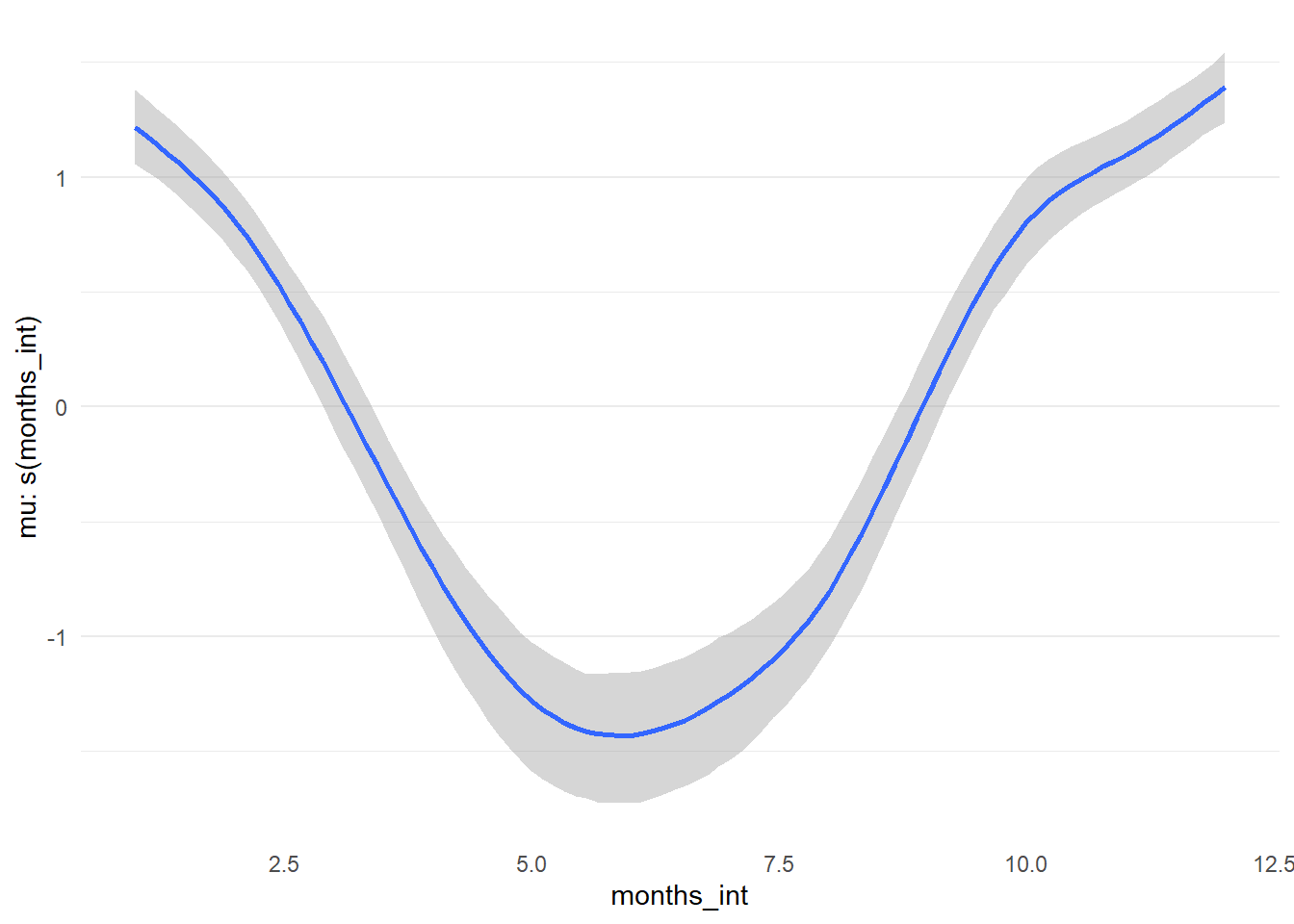

The final check we will examine is for the spline term in the model named model_level_slope_season_s. I believe I am not alone when I say “I cannot understand spline terms well from looking at a summary table”. Although a simple categorical field for season is easier to understand, a spline term may provide a better fit.

model_level_slope_season_s## Family: poisson

## Links: mu = log

## Formula: cases ~ months_elapsed + event + event_elapsed + s(months_int)

## Data: sim_data (Number of observations: 60)

## Draws: 4 chains, each with iter = 2000; warmup = 1500; thin = 1;

## total post-warmup draws = 2000

##

## Smooth Terms:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## sds(smonths_int_1) 2.92 0.90 1.66 5.20 1.00 557 784

##

## Population-Level Effects:

## Estimate Est.Error l-95% CI u-95% CI Rhat Bulk_ESS Tail_ESS

## Intercept 1.21 0.12 0.98 1.44 1.00 1925 1490

## months_elapsed 0.06 0.00 0.05 0.07 1.00 2167 1519

## eventafter -1.46 0.13 -1.72 -1.20 1.00 2032 1404

## event_elapsed -0.10 0.01 -0.13 -0.08 1.00 1918 1606

## smonths_int_1 -0.08 0.24 -0.55 0.40 1.00 2208 1477

##

## Draws were sampled using sampling(NUTS). For each parameter, Bulk_ESS

## and Tail_ESS are effective sample size measures, and Rhat is the potential

## scale reduction factor on split chains (at convergence, Rhat = 1).Thankfully, {brms} providers a method to examine the effects of smoothing term via the function conditional_smooths(). Below we can examine the trend for the parameter estimated through the spline function on months. This captures the trigonometric function from our simulated data quite well (recall: 1.5 * cos(pi*time_steps / 6)), which dipped to a minimum in summer months.

cond_s_plot <- conditional_smooths(model_level_slope_season_s)

# Output of `conditional_smooths` isnt directly compatible with ggplot2...

plot(cond_s_plot, plot = FALSE)[[1]] + theme_minimal() +

theme(panel.grid.minor.x = element_blank(),

panel.grid.major.x = element_blank())

Figure 12: Spline term by month for model_level_slope_season_s.

Model comparison

We have fit various models during this journey, which we naturally want to compare to discover which is “best”. To help ensure we are not over- or under-fitting, we can perform a Bayesian approach to leave-one-out cross validation provided in the {loo} package called Pareto Smoothed Importance Sampling (PSIS-LOO). The main idea here is that higher values of expected log predictive density (ELPD) reflect a better performing model (in general). While using this approach, the Pareto k diagnostic can warn you about outliers; these data points can have a high influence on the model, leading to strange fits. Sometimes this is an indication of model misspecification, which could be adjusted directly (e.g. dropping outliers) or perhaps by switching to an alternative distribution (e.g. such as a Gamma-Poisson model).

We will compare seven models that have been crafted including: the null model, models without any intervention parameters, different intervention impact models, and models that incorporate seasonality. We will exclude the model with the autoregressive term as there were several indications that it was having difficulty during the fitting process (even after some tweaking). To perform this comparison, we loop through each model and assign the output of loo() via add_criterion(). This saves the calculation to the model so we don’t have to rerun it. We can then compare all the models at once via loo_compare().

# Add LOO criterion to all models

# Moment matching required to tame a couple higher Pareto k points

list2env(lapply(list('model_null' = model_null,

'model_time' = model_time,

'model_slope' = model_slope,

'model_level' = model_level,

'model_level_slope' = model_level_slope,

'model_level_slope_season' = model_level_slope_season,

'model_level_slope_season_s' = model_level_slope_season_s),

\(x) add_criterion(x, 'loo', moment_match = TRUE)),

envir = knitr::knit_global())

model_level_slope_season_ar <- add_criterion(model_level_slope_season_ar, 'loo',

reloo = TRUE,

reloo_args = list(cores = 4))

# Compare

compare_table <- loo_compare(model_null,

model_time,

model_slope,

model_level,

model_level_slope,

model_level_slope_season,

model_level_slope_season_s)

compare_table## elpd_diff se_diff

## model_level_slope_season_ar 0.0 0.0

## model_level_slope_season_s -4.9 5.2

## model_level_slope_season -34.7 11.0

## model_level_slope -338.6 65.3

## model_slope -363.1 74.0

## model_level -367.2 73.4

## model_time -464.6 114.8

## model_null -472.8 116.8The results of the comparison are in reference to the model with the highest ELPD. After seeing the earlier plots and excluding the AR model, it is probably unsurprising that the best fit is model_level_slope_season_s, which has the spline term for seasonal effects.

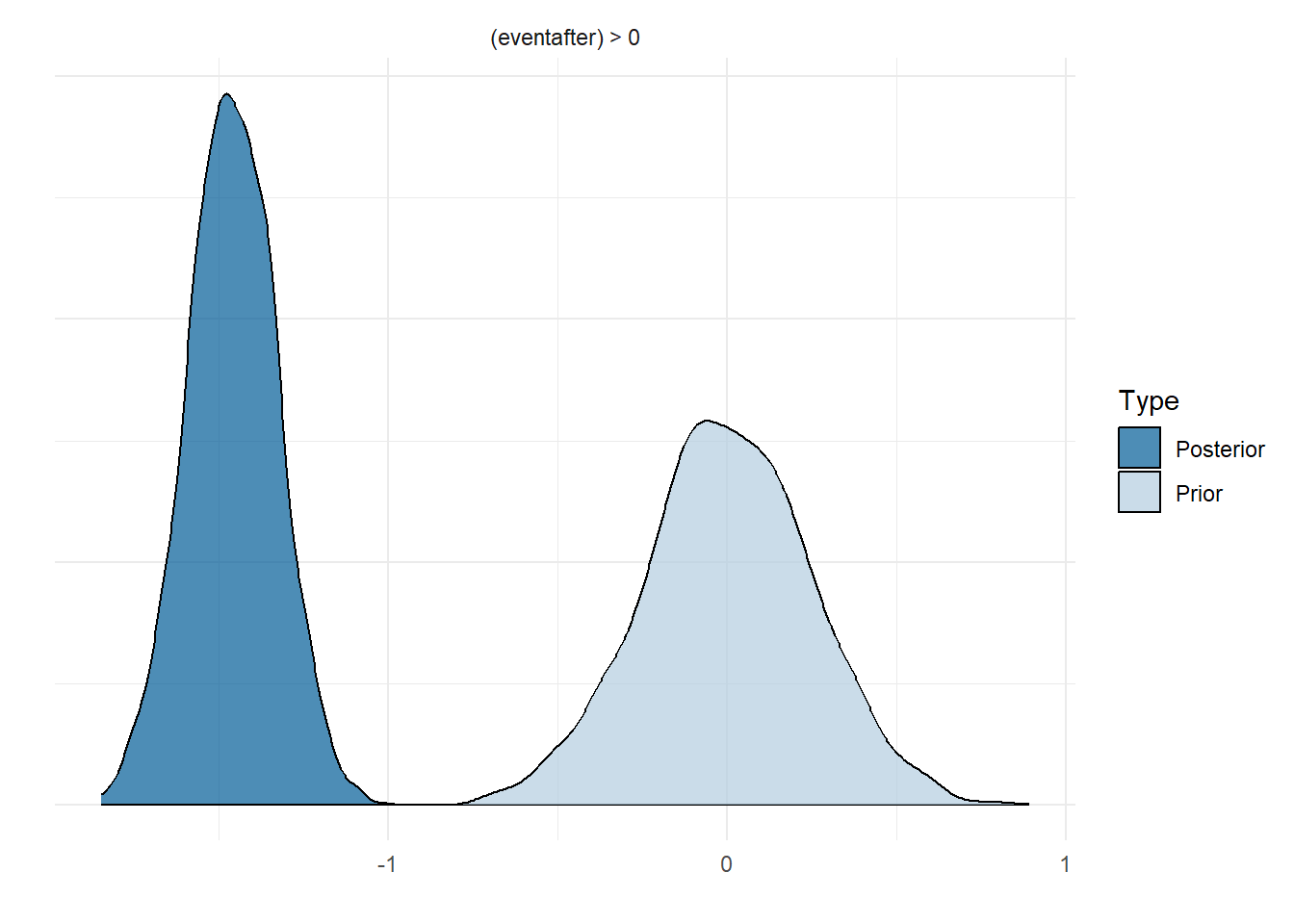

Hypothesis testing

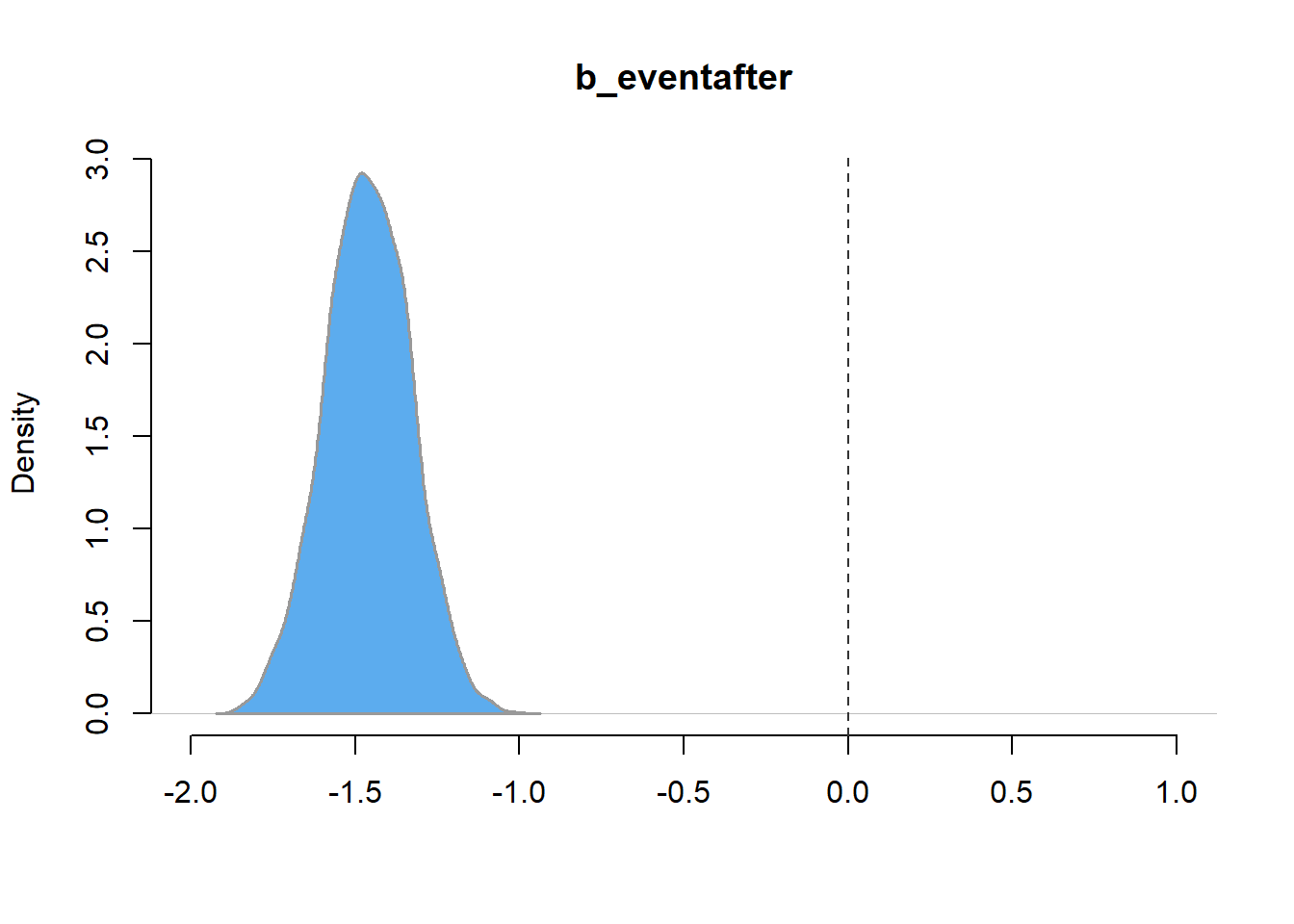

If you are familiar with hypothesis testing from Frequentist methods, you may be happy to hear that Bayesian has a comparable method. We will only touch on this briefly. There are two main types, one-sided and two-sided hypotheses. The former compares the ratio of posterior probabilities but the latter makes reference to prior distributions; consequently, reasonable priors must selected to ensure the results are not biased. Although our own priors could be improved, we will show the method for sake of example using the model named model_level_slope_season_s. The figure below show the chances that the intervention had a positive change in level (i.e. increased cases). Unsurprisingly, the model does not have evidence to support this claim. You may notice that the Estimate is the same as the parameter value (on the log scale) from the model summary.

hypoth <- brms::hypothesis(model_level_slope_season_s,

"eventafter > 0")

knitr::kable(hypoth$hypothesis) |>

kableExtra::scroll_box(box_css = "",

extra_css = 'overflow-x: auto; width: 100%')| Hypothesis | Estimate | Est.Error | CI.Lower | CI.Upper | Evid.Ratio | Post.Prob | Star |

|---|---|---|---|---|---|---|---|

| (eventafter) > 0 | -1.461634 | 0.1305311 | -1.678089 | -1.246995 | 0 | 0 |

This is easier to see by graphing the posterior distribution of the parameter, as compared to the prior. As is obvious in the figure below, no weight of the posterior exists above 0.

plot(hypoth, theme = theme_minimal())

Figure 13: Prior and posterior distribution for level change parameter in model_level_slope_season_s.

The {brms} package makes this type of check easy to perform, but there is no reason why we could not simply do it ourselves by directly sampling the posterior.

post_sample <- as_draws_matrix(model_level_slope_season_s, 'b_eventafter')

knitr::kable(caption = 'Summary statistics for posterior values of the level parameter from model_level_slope_season_s.',

data.frame(mu = mean(post_sample),

sd = sd(post_sample),

`hypoth` = mean(post_sample > 1))) |>

kableExtra::scroll_box(box_css = "",

extra_css = 'overflow-x: auto; width: 100%')| mu | sd | hypoth |

|---|---|---|

| -1.461634 | 0.1305311 | 0 |

plot(density(post_sample),

type = "n",

frame.plot = FALSE,

main = 'b_eventafter',

xlab = '',

xlim = c(-2, 1))

polygon(density(post_sample),

lwd = 1.5,

border = 'grey60', col = 'steelblue2')

abline(v = 0, col = 'grey20', lty = 'dashed')

Figure 14: Distribution of posterior samples of the level parameter model_level_slope_season_s.

Compare predictions

We have come quite a long way and we may have forgotten that our dataset was simulated from a known set of values. Now we will have the chance to see how well our preferred model (model_level_slope_season_s) estimated the actual generative process. If you have forgotten what that was, feel free to take a peek in the previous post.

In an earlier section, we already had a look at how model_level_slope_season_s estimated seasonal effects. Although not perfect, it did pick up the dip in Summer and rise in Autumn.

We also want to know how well this model estimated the main trend, level change, and slope change following the intervention. Again, the model is not perfect, but it does get quite close!

knitr::kable(data.frame(Parameter = c('alpha (Intercept)', 'main_trend', 'event_trend (slope)', 'after_trend (level)'),

Simulated = c(1, 0.07, -2, -0.08),

Estimate = round(fixef(model_level_slope_season_s)[1:4,1], 2)), row.names = FALSE)| Parameter | Simulated | Estimate |

|---|---|---|

| alpha (Intercept) | 1.00 | 1.21 |

| main_trend | 0.07 | 0.06 |

| event_trend (slope) | -2.00 | -1.46 |

| after_trend (level) | -0.08 | -0.10 |

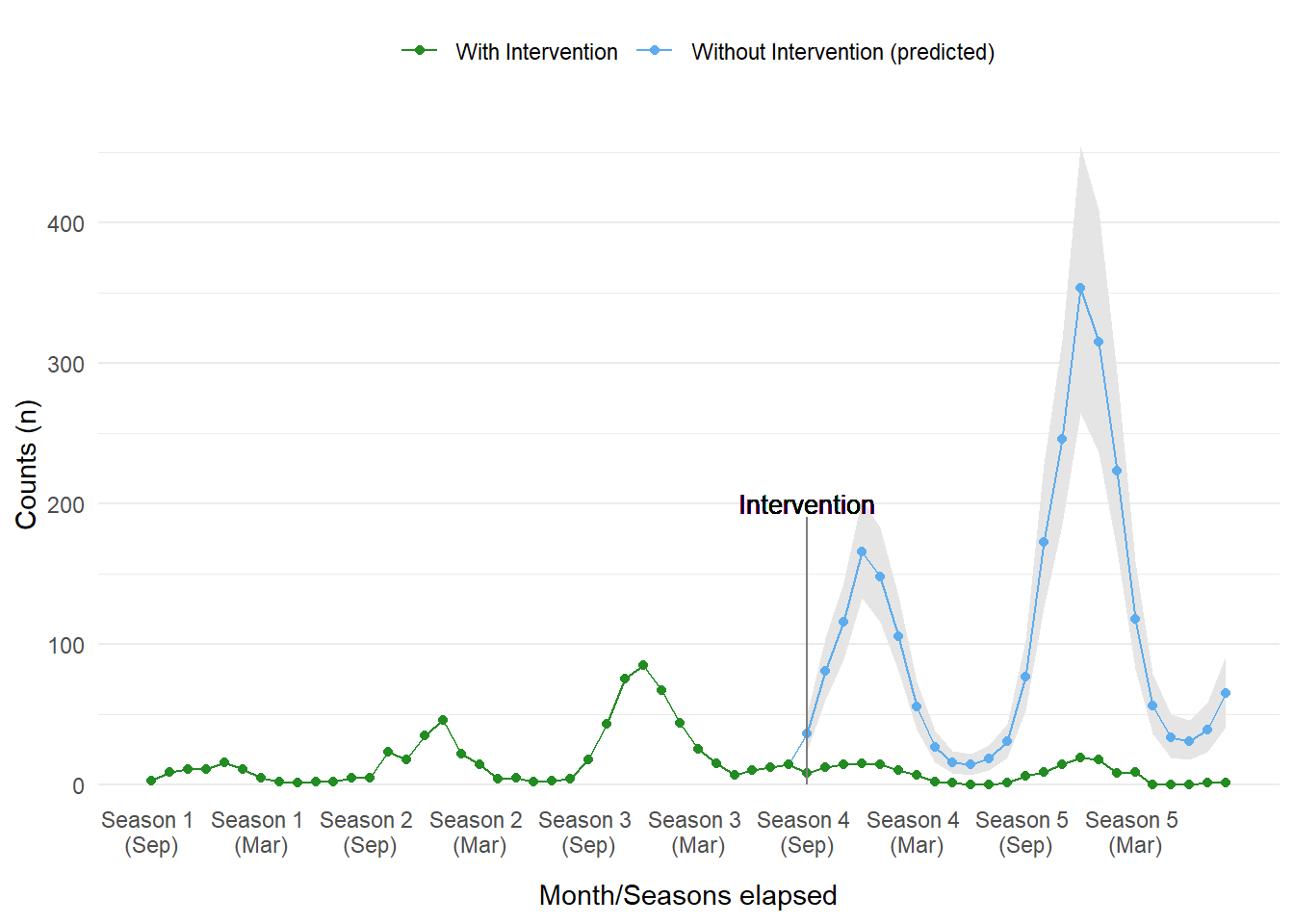

Counterfactual

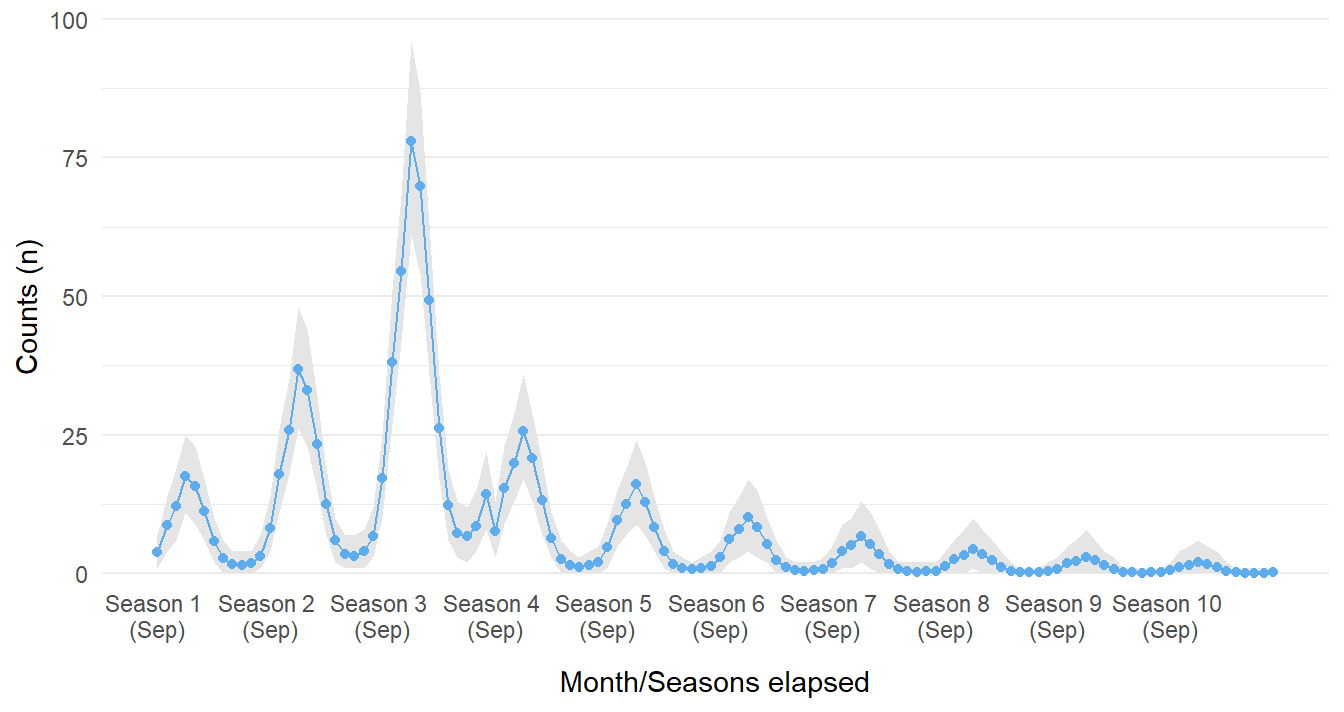

A common usage of ITS analysis is to create a counterfactual plot, a scenario that describes what the outcome would be had the intervention never occurred. We can do this quite easily, we just need to extrapolate components of the model. Without the intervention the model shows an increasing, and worrying, peak in cases every season.

# Create counter factual data

counterfact <- sim_data

counterfact$event <- 'b4'

counterfact$event_elapsed <- 0

# Run counter factual into fit model, bind to other parameters

pred_cf <- predict(model_level_slope_season_s,

probs = c(0.05, 0.95),

newdata = counterfact) |>

as.data.frame() |>

cbind(counterfact)

# Plot...

ggplot_its_base(pred_cf, n_years = n_years) +

geom_ribbon(data = pred_cf[N_b4+1:N,], aes(ymin = `Q5`, ymax = `Q95`), fill = 'grey90') +

geom_point(data = pred_cf[N_b4+1:N,], aes(y = Estimate, color = 'Without Intervention (predicted)')) +

geom_line(data = pred_cf[N_b4:N,], aes(y = Estimate, color = 'Without Intervention (predicted)')) +

geom_point(aes(y = cases, color = 'With Intervention')) +

geom_line(aes(y = cases, color = 'With Intervention')) +

geom_segment(aes(x = N_b4 + 1, xend = N_b4 + 1, y = 0, yend = 190), color = 'grey50') +

geom_text(aes(x = N_b4 + 1, y = 200, label = 'Intervention'), size = 3.5, color = 'black') +

scale_color_manual(values = c('Without Intervention (predicted)' = 'steelblue2', 'With Intervention' = 'forestgreen'))

Figure 15: Counterfactual plot from model_level_slope_season_s.

A caution about forecasting…

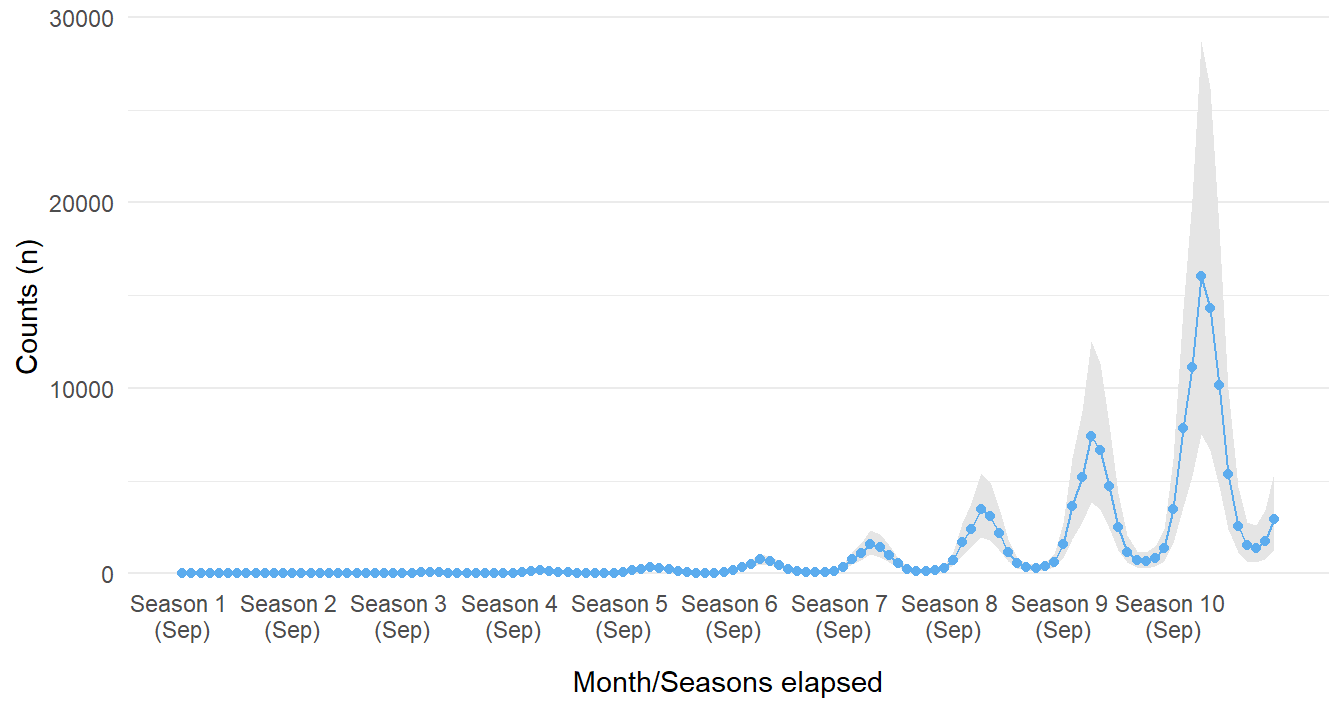

If the prior section made you raise an eyebrow, that is good. We should be skeptical of our models, they are at best a pale shadow of reality. It would likely be a grave mistake to assume the ITS model used here can be used to predict into the far-flung future. There are many reasons why this is ill-advised, but showing it graphically will make this clearer.

Since we opted to use a Poisson distribution, the relationship of cases over time is exponential. We observe some odd (read as: unbelievable) outcomes if we project the same trend for five more years. The farther into the future we go, the stranger our assumptions in our rather simplistic model makes. From the figure below the model is suggesting that, quite quickly, all of humanity could be infected with this disease if the intervention was not implemented. This is most certainly unrealistic. There appears to be no other mechanism to stabilize or decay the growing trend. Where the counterfactual plots may have provided some interesting insight, assuming the same growing pattern continues in perpetuity is likely fallacious. We should question the model and its assumptions.

# Create counter factual data

forecast_data <- rbind(sim_data, sim_data)

forecast_data$event <- 'b4'

forecast_data$event_elapsed <- 0

forecast_data$months_elapsed <- 1:nrow(forecast_data)

predict(model_level_slope_season_s,

probs = c(0.05, 0.95),

newdata = forecast_data) |>

as.data.frame() |>

cbind(forecast_data) |>

ggplot_its_base(n_years = 10, x_label_step = 12) +

geom_ribbon(aes(ymin = `Q5`, ymax = `Q95`), fill = 'grey90') +

geom_point( aes(y = Estimate), color = 'steelblue2') +

geom_line(aes(y = Estimate), color = 'steelblue2') +

guides(x = guide_axis(check.overlap = TRUE))

Figure 16: Forecasted counts for ten seasons if intervention never occured in Season 4.

Similarly, we can also ask the model to predict outcomes many seasons after the intervention was implemented (after the fourth season of the disease being observed). The figure below suggests that cases approach and essentially reach zero. This most likely will create a false sense of security; it is possible the infectious agent would mutate to evade the treatment!

forecast_data <- rbind(sim_data, sim_data)

forecast_data$event[(N_b4+1):nrow(forecast_data)] <- 'after'

forecast_data$event_elapsed[(N_b4+1):nrow(forecast_data)] <- seq_along((N_b4+1):nrow(forecast_data))

forecast_data$months_elapsed <- 1:nrow(forecast_data)

predict(model_level_slope_season_s,

probs = c(0.05, 0.95),

newdata = forecast_data) |>

as.data.frame() |>

cbind(forecast_data) |>

ggplot_its_base(n_years = 10, x_label_step = 12) +

geom_ribbon(aes(ymin = `Q5`, ymax = `Q95`), fill = 'grey90') +

geom_point(aes(y = Estimate), color = 'steelblue2') +

geom_line(aes(y = Estimate), color = 'steelblue2') +

guides(x = guide_axis(check.overlap = TRUE))

Figure 17: Forecasted counts for ten seasons if intervention did occur in Season 4.

Wrapup

If you have made it this far, congratulations, you are likely one among few. We have started with simulating a fictional disease that varies by season and was brought under control with a new drug intervention. By using Bayesian methods, we were able to fit various models describing different assumptions on the impact of the intervention. Through a whirlwind of model sanity checks and comparison we selected one that performed well and got pretty close to some of the actual parameter values used in the generative process. If you can’t get enough of ITS modeling, take a look at the references in the next section to continue your journey!

References

There is a wealth of content on Interrupted Time Series as well as their applications in the R language that span articles, textbooks, and blogs. A selection referenced for part 1 and part 2 of this post are below:

- Interrupted time series regression for the evaluation of public health interventions: a tutorial

- Fitting GAMs with brms

- Interrupted Time Series

- Modeling impact of the COVID-19 pandemic on people’s interest in work-life balance and well-being

- Applied longitudinal data analysis in brms and the tidyverse

- Interrupted time series analysis using autoregressive integrated moving average (ARIMA) models: a guide for evaluating large-scale health interventions

- {brms}

- Primer on Bayesian statistics and modeling